AFRAA ASSEMBLY DISCUSSES THE FUTURE OF AFRICAN AVIATION

(Posted 26th November 2013)

The AFRAA Secretary General, Dr. Elijah Chingosho, provided the 30 member airlines and hundreds of delegates registered at the ongoing Annual General Assembly with an array of details about African aviation, underscoring once again the key points of the need to improve aviation safety, the high regulatory costs, high fees and taxes on tickets, far lower loadfactors compared to the rest of the world, the lowest passenger numbers and air movements in comparison with all other continents and the challenges of by and large ageing fleets, apart from the top airlines.

In addition did the Secretary General’s annual report also highlight the range of activities undertaken by AFRAA across the year on behalf of and in conjunction with member airlines before outlining the challenges ahead for the year 2014 and beyond.

Many readers, especially those keenly following the aviation reporting here, have specifically requested to make more details available about the proceedings in Diani Beach’s Leisure Lodge Resort and to provide them with the various presentations, the data and graphs, topics covered and conclusions drawn.

In view of this I have requested AFRAA to provide the full presentation of Dr. Chingosho, which they have done together with their permission to reproduce key elements from what was said yesterday on opening of the AGA. In addition has AFRAA asked to publish on their behalf the details of how to follow the events via Twitter, Facebook, on their website and a specially created link to access streaming content from the conference hall, when proceedings are in progress:

The 45th AFRAA Annual General Assembly is streaming live through the link: http://goo.gl/9g3yyL

Follow us on Twitter: @AfricanAirlines

Follow us on Facebook: https://www.facebook.com/AFRAA.AfricanAirlinesAssociation

The official AFRAA AGA 45 hashtag: #AFRAA45AGA

Relevant information from the closing day of AFRAA’s 45th Annual General Assembly will be provided as and when details become available through the AFRAA Secretariat on location in Diani Beach or their headoffice in Nairobi. Watch this space for regular and breaking aviation news and ongoing coverage of this key African aviation event.

INTRODUCTION

Mr. President, distinguished guests, ladies and gentlemen; in response to the MC’s invitation, allow me now to present to you the customary report of the Secretary General. This is a summary. The Annual report is included with your AGA documentation.

In this particular time of great opportunities, we ought to take stock, evaluate the state of our industry, appreciate our strengths and weaknesses, take cognizance of the driving forces of the market and strategize accordingly so as to exploit the opportunities and come out as sustainable and strong winners henceforth.

This report will, therefore, be structured as follows:

Performance of the industry globally and in Africa

Main Secretariat activities during the year

The future challenges and opportunities

Conclusions

Africa has the potential to be a significant force in aviation on the back of robust economic growth forecasts, with Africa having among the fastest growing economies worldwide. North African economies are also rebounding after disruptions arising from revolutions in 2011.

The areas I will briefly cover are shown on the screen.

African Air Transport Growth Prospects

Tourism

Global Airline Industry Performance 2012

Airline Global Performance

African Airline Performance

Freight Traffic

Fleet Composition and Development

Jet Fuel Cost

African Air Transport Growth Prospects

The performance of the African aviation industry is lagging behind those of the rest of the world at less than 3% of global RPKs. The growth is heavily constrained by the high industry costs, inadequate infrastructure at several airports, slow implementation of the Yamoussoukro Decision, lack of a single traffic rights negotiating body with respect to third parties like the EU. Nonetheless, demand for air transport has increased steadily over the past years with passenger numbers and freight traffic growing significantly.

Over the period 2010-2015, Africa will be one of the fastest growing regions in the world in terms of international traffic with an average growth rate of 6.1% compared to the global average of 5.8%. However, African aviation needs to grow at double digit rates to be a significant player in the global industry.

Middle East and Asia Pacific will however surpass Africa’s growth at 7.9% and 6.9% respectively. Europe, Latin America and North America are projected to record lower international passenger growth of 5.0%, 5.8% and 4.9%, respectively. The positive growth trend is expected to continue in the coming years due to robust economic growth, demographic boom, increasing urbanization, and emergence of the middle class.

Tourism

According to UNWTO, international tourism arrivals reached 1.035 billion in 2012; 39 million more than in 2011. Global tourism contributed 9.1% to world GDP, 5.9% of worldwide exports and 4.5% of global investment in 2012.

The breakdown of international tourism traffic is shown on the figure with Europe accounting for more than half, followed by Asia Pacific with 22% international tourist arrivals in 2012 and Africa representing only 5%.

Africa saw the second highest growth across the world with 3 million more tourist arrivals in 2012. This is equivalent to a 6% increase. According to UNWTO, in 2012, Africa attracted 52 million visitors and receipts from tourism for 2012 amounted to over US$36 billion. Sub-Sahara Africa is outpacing other regions in tourism growth. Africa’s tourism revenues are rising fast and are set to contribute more and more to world activity.

Source: UNWTO

Global Airline Industry Profitability 2012

Global airline profitability declined in 2012 to a net profit of US$7.4 billion or about 14% on 2011, way below the strong performance of the industry in 2010 when net profits were above US$19 billion. Results were mixed across regions, but Asia Pacific airlines achieved the strongest results with a net profit of US$3.9 billion. African airlines however made a loss of US$0.1 billion.

Source: IATA

Global Traffic Performance

According to IATA global passenger air traffic (RPKs) improved by 5.3% in 2012 compared to 2011. International markets had an increment of 6.0% while domestic markets grew by 4.1%. In line with the traffic upward trend, seat capacity (ASKs) increased by 4.3% and 4.0% on international and domestic routes respectively. With this, the average load factor increased to 79.2%.

IATA estimates of scheduled world cargo traffic (FTK) decreased by 1.1% in 2012 compared to 2011. International freight traffic, which accounts for more than 87% of total FTKs, decreased by 1.3%, while domestic freight traffic increased by 0.3%. IATA member airlines freight traffic (FTKs) on all scheduled services suffered a decline of 0.5% compared to 2011’s decline of 0.4%.

System-wide, the Asia Pacific region was the world’s biggest air transport market by RPKs performed (31.4%) in 2012, followed by Europe and North America at 26.3% and 24.6% respectively. Africa remains the smallest market, accounting for about 2.8% of global RPKs.

African Airlines Performance

Passengers Carried

Passenger numbers has grown consistently year on year since 2004 except in 2011 where the numbers dipped as a result of the Arab Spring and political instability in parts of North Africa. From less than 40 million passengers carried in 2004 by African airlines, passenger numbers have increased to 62.9 million in 2012; a cumulative growth of 61.5% (average annual growth 7.8%), up from the 2011 figure of 56.4 million.

The high GDP growth experienced in 2012 coupled with the attractiveness of Africa as a source for mineral resources and an increasingly attractive investment destination continue to attract foreign investments. African airlines therefore continued their aggressive network expansion, new markets development and further penetration of their domestic and intra-Africa markets. As a result, passenger numbers increased on domestic, intra-Africa and intercontinental routes. The total number of intercontinental passengers carried increased to 26.7 million from 23.6 million in 2011.

Domestic and Intra-Africa Passengers

Domestic passenger numbers increased by over 8% to 19.4 million due an increase in access to air travel, lower fares and new routes launched in 2012. The growing competition in many domestic markets and the resultant improvement in service quality and lower fares continue to stimulate demand. Low Costs Airlines, particularly in South Africa, Kenya, Egypt, Kingdom of Morocco and lately Tanzania continue to aggressively promote and attract more passengers, some of whom had never flown by air before.

Intra-Africa passenger numbers went up 12.75% to 16.8 million, up from 14.9 million in 2011. This growth was driven largely by the rapidly growing business and trade between African countries and the growing middle class, some of whom now prefer air travel.

With a population of over 1.07 billion, spread across the vast the continent of 54 countries, there is huge potential for growth in intra-Africa air travel. The major constraint to the growth of intra-Africa growth is the slow pace of liberalisation and the over-dependence Bilateral Air Services Agreements (BASAs) by many States as well as the high taxes, fees and charges on passengers, fuel and other services.

Intercontinental Passengers

Intercontinental passenger numbers in 2012 increased by 12.9% over 2011. African airlines share of this was 5.1% in the year under review, bringing total passengers carried on intercontinental routes to 26.7 million. Non-African airlines carried 7.8% more passengers. The continued economic slowdown in the Eurozone reduced the traffic flow from that market, especially leisure traffic. The political crisis in some countries in North Africa also shied away tourists to the region in the year under review. This was however compensated for by an increase in the number of passengers from Asia, the Middle East and the Americas to sub-Sahara Africa. Non-African airlines still carry the bulk of traffic to/from Africa, accounting for 78.4% of all passengers carried on intercontinental routes in 2012.

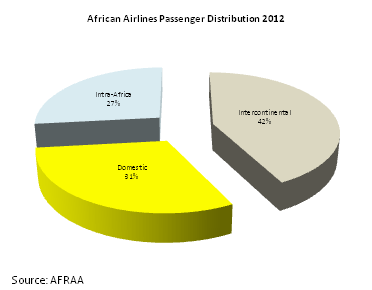

Passenger Distribution

Intercontinental passenger market segment remains the biggest with 42% of all passengers travelling between Africa and other regions of the world. The domestic market segment represents 31% while the intra-Africa market is 27%.

Passenger Load Factor

The imbalance of capacity and demand continues to create inefficiencies in many African airlines. Average passenger load factor (PLF) improved marginally by 0.8% to 69.7%. This compares unfavourably to global average PLF of 79.2% for 2012.

Mismatch of capacity to demand, limited commercial cooperation and the uncoordinated networks among most African operators are some of the reasons for the poor load factor on intra-Africa routes. The deployment of high-capacity aircraft on low and mid-density markets drives down load factor and also acts as a disincentive to more frequencies where they may be needed.

Freight Carried and Traffic

Air freight shipment in Africa is still very low. In 2012 the continent airlines carried about 788500 tonnes of total global freight carried, representing 1.8% of total air freight shipment. AFRAA member airlines in 2012 carried a total of over 710800 tonnes. In FTKs, this represents a growth of 11.7% compared to 2.7% in 2011. The Middle East and Africa recorded the highest year-on-year air freight growth of 12.8% and 11.0% respectively.

Already, major African carriers such as Egypt Air, Ethiopian, Kenya Airways, and South African Airways are investing substantial resources to grow their air freight business. This will reduce the hitherto over reliance on belly-space for cargo shipment, which is limited and subject to baggage load.

However, the failure by many African airlines to develop the cargo component of their operations has led to dominance of the intercontinental sector by non-African airlines. On the domestic and intra-Africa segments, the bulk of freight is transported by rail or road due to lack of capacity and bureaucratic customs clearance processes at airports.

Freight Traffic Forecast

IATA survey showed that airlines on average expect air freight tonnes to grow by 3% annually over the next 4 years to 2016 on international markets. The manufacturers in their long term forecast expect air freight demand (FTKs) growth to average 4.9 – 5.2% over the next 20 years. IATA maintains its long term forecast of 5% average growth.

Fleet Composition and Development

Global commercial airline fleet in 2012 was composed of 20,320 passenger aircraft and 1,730 freighters according to Boeing. By 2032, this is expected to double to 41,240. Between 2013 and 2032, 35,280 new aircraft are expected to added to or replace some existing fleet in operation. The total cost of the additional fleet is estimated at over US$4,860 billion.

Africa passenger aircraft make up of 690 (3.4%) of the total global fleet. There are also about 10 freighters in operation. AFRAA airlines in 2012 operated a total of 573 aircraft or 83% of total African commercial fleet

Africa Fleet and Forecast

Currently 61% of the total of 690 aircraft in operation in Africa is made up of single aisle type. Wide body (large, medium and small) constitute up 24% and regional jets 17%.

Africa is forecast to require 1,070 new airplanes over the next 20 years to 2032. Of this, about 70% will be single aisle aircraft, 19% small wide body and 9% regional jets. Medium wide body aircraft will constitute about 3%. The total number of commercial aircraft to be in operations in Africa by 2032 will almost double to 1,500.

The average age of the current African fleet is about 14 years. Fleet is composed of 150 large to small wide body, 420 single aisle planes and 120 regional jets.

Jet Fuel Cost

According to IATA, in 2012 on average, fuel accounted for 33% of total airline operating costs, although higher in some regions. In Africa for instance, fuel accounted for between 45-55% of operating costs.

The price of jet fuel in 2012 increased by 1.7% to average US$129.5 per barrel compared with US$127.5 in 2011. This meant that fuel price stayed at the high level reached in 2011 for the most part of 2012, placing sustained pressure on the airline industry profit margin.

AFRAA SECRETARIAT VALUE ADDED ACTIVITIES

The activities of the Secretariat are guided by the AFRAA Business Plan approved by the Executive Committee.

The report covers safety, training, industry costs, enhancing image of African airlines, environment, liberalization of air transport services, strengthening AFRAA’s continental representation and leadership role. I now highlight the activities by the Secretariat to meet specified targets.

Safety

Safety is the top priority of AFRAA but still remains a major challenge. To enhance safety, AFRAA is committed to work with several stakeholders including ICAO, AFCAC, IATA, AASA and regional economic communities.

Currently 39 African airlines are IOSA Certified and the number of airlines preparing for IOSA certification continues to increase.

AU Heads of State Endorsement of IOSA

Following recommendations of Ministers responsible for Aviation after their conference in Abuja on 16-20 July 2012, the Heads of State of the African Union endorsed the requirement for all African airlines to be IOSA registered by 2015. This is a major milestone which should see safety standards in Africa reach world levels and ensure that all African States and airlines are out of the EU banned list.

AFRAA is working closely with IATA, AFCAC and ICAO to facilitate the achievement of the safety targets for Africa by 2015 mainly through capacity building and providing advisory services for airlines preparing for IOSA audits.

Safety Training

AFRAA conducted 14 safety courses and workshops by October this year mainly focused on helping airlines seeking IOSA registration. We are gratefully to IATA who sponsored 4 of the courses to enable airlines attend for free.

Training and Human Capital Development

Developing people is among the top priorities of AFRAA to ensure that African aviation continues to grow using highly trained and capable personnel.

In 2012 the AFRAA Secretariat conducted 17 training courses and 4 workshops/seminars. Our collaboration with the IATA Airline Training Fund (IATF) for the development of capacity continues to grow. In 2012 IATF sponsored 6 free courses which were allocated to airlines to assist them in preparing for IOSA registration. AFRAA in collaboration with IATA conducted 4 workshops/forums which were well attended by airlines.

World class African training centres in Egypt, Ethiopia, Kenya, Libya, Kingdom of Morocco, Seychelles and Tunisia are on the AFRAA website and Annual Report to facilitate bilateral co-operation among airlines.

AFRAA Fuel Project

AFRAA in 2011 launched the joint fuel project. Following the initial success, the second tender was issued in 2012 for jet fuel procurement in 2013. The number of airlines has increased from 8 to 14 and the pooled fuel volumes more than double to over 1.0 billion litres. Negotiations are on-going for the 2014 tender and expected to conclude by the end of November.

To develop capacity in cost effective fuel management, AFRAA in partnership with IATA organised a two-day course on fuel at the AFRAA Headquarters in Nairobi in October, attended by 25 trainees from 12 airlines.

Taxes, Fees and Charges

Taxes, fees and charges on African airlines, and passengers are still among the highest in the industry. During the year, AFRAA did analysis and identified the various high taxes and charges applied to airlines by some States and service providers. This information enabled us to do lobbying work for reduction.

AFRAA and IATA have joined hands in lobbying to reduce charges, fees and taxes on fuel, and indeed some progress has been noted as follows:

In Angola, the national oil company agreed to reduce fuel taxes in 2012 by 20% with the resulting savings of about US$ 110 million annually for airlines operating to that country;

In Ghana, the Government reduced by 75% the stabilisation fund cross- subsidy on the country’s jet fuel price formula, which is estimated to save airlines flying to that country US$ 37 million annually;

In Seychelles, the government replaced a 15% goods and services tax (GST) on a ticket with a VAT zero-rated for international travel, saving airlines US$ 22 million annually.

In West & Central Africa, the air navigation service provider, ASECNA, agreed to continue to freeze charges from the region for eight consecutive years.

Route Network Coordination

AFRAA launched a Route Network Cooperation Task Force aimed at optimising the schedules of participating airlines, develop virtual alliances and deliver incremental revenues. A number of airlines have shown interest in the project.

The project consultant is Sabre Airlines Solutions, which has vast experience in supporting similar initiatives in the Middle East and Latin America. A MoU was signed in March between AFRAA and Sabre. The project potentially could increase passenger revenue significantly.

Ground Handling Cooperation

AFRAA is promoting a Joint Ground Handling Project to address some of the common challenges faced by airlines at some airports as well as reducing costs.

Regulatory Issues

Aero-political and regulatory priorities throughout the year were focused on pushing for the full implementation of the Yamoussoukro Decision (YD), the operationalization of the Executing Agency of the YD, promoting the adoption of the Montreal Convention of 1999 by all States, lobbying for more States to accede to the Cape Town Convention and Protocol, lobbying against the EU banned list and EU ETS scheme as well as updating airline legal and regulatory affairs officers of global and regional developments in the sector.

AFRAA is pleased that the 38th ICAO Assembly came up with a global deal on aviation emissions in early October this year. The agreement puts in place a fair and equitable solution that respects the special circumstances and respective capabilities in which a number of countries, especially third world countries, find themselves.

Land Development

AFRAA has a piece of valuable unused land at its headquarters in Nairobi. The Association wants to develop this land to generate additional revenue. This will enable AFRAA to fund more activities for the benefit of members. We are currently reviewing proposals to develop the land on a Build-Operate-and Transfer basis, as directed by the Executive Committee.

Communication and Information Dissemination

One of the key areas of focus by AFRAA is to enhance the knowledge base of its stakeholders about developments within the African aviation industry. In this regard, AFRAA has developed a number of communication channels through which it disseminate accurate, relevant and timely information to member airlines, partners and other stakeholders. Stakeholders now receive regular communication through a variety of publications.

We have consistently published a monthly e-newsletter, quarterly Africa Wings magazine, made regular press releases and media interviews designed to promote the image of African aviation. The world class MROs, training centres, and simulator providers have been featured in our revamped website.

New Members and Partners

The Association continues to recruit new members and partners with the objective of providing support to airlines.

We warmly welcome the one airline and 8 partners that joined AFRAA this year. The new member airline is Marsland Aviation Company. The 8 new Partners are: Atlantic FuelEx, IC Publications, HADID International Services FZE, Linkham Consulting, Marsh Ltd, MTU Maintenance, WireCard Technologies, and ACS Aviation Solutions .

AFRAA partners continue to provide valuable support to the development of African aviation through financial and non-financial contributions to the Secretariat and member airlines. We greatly value their support.

Working with other Organisations

AFRAA cooperates with the African Union Commission, NEPAD, AfDB; other major industry organisations including IATA, AASA, AACO, ICAO, AFCAC, ACI-Africa; governmental and non-governmental bodies, Regional Economic Communities (RECs) – ECOWAS, EAC, COMESA, SADC, UEMOA; manufacturers and service providers. This collaboration accords AFRAA goodwill and a broad framework resources and assistance that benefits members, protecting their interest and provides support for better economic environment for their operations.

Recovering Intercontinental Market share and African Aviation Vision 2063

The Secretariat carried out a study on how African airlines can recover intercontinental market share which is currently heavily dominated by non-African airlines. The study was debated by the Executive Committee who made many insightful contributions. The study has since been distributed to member airline CEOs for them to incorporate some of the ideas into their strategic plans.

The African Union celebrated 50 years this year. This was an opportune moment for the organisation to reflect on its performance in the past 50 years and to chart a vision for the next 50 years.

AFRAA and AFCAC were requested and jointly came up and submitted the Vision 2063 for African Aviation for incorporation into the AU Vision 2063.

FUTURE CHALLENGES AND OPPORTUNITIES

In this section I highlight the major future activities and opportunities for African aviation that are shown on the screen:

Safety

African carriers recovering intercontinental market share

Industry costs

Improved infrastructure and use of the latest ICT technologies

Promotion of the implementation of AFCAP

Human capital development.

Safety

Going forward, safety will continue to be the greatest challenge facing African aviation. We need to tackle safety issues seriously and head-on. AFRAA will strengthen collaboration with various organisations particularly IATA, AFCAC and ICAO to jointly facilitate the attainment of industry best practices in safety.

AFRAA will assist airlines to attain and maintain IOSA registration by providing training as well as facilitating cooperation and assistance among African Airlines particularly in availing expertise and sharing of experiences in this area. AFRAA has teamed up with Aviation Compliance Solutions (ACS), an IATA IOSA approved auditing firm, to develop IOSA auditors so as to reduce cost and make it more affordable for airlines to obtain and maintain IOSA registration.

African Carriers Recovering Intercontinental Market Share

Currently non-African carriers transport about 80% of the intercontinental traffic to and from the continent. It is necessary to ensure that African aviation plays its part in ensuring the economic, social and political integration of African States. In this regard, it is critical that the African Union puts in place policies that facilitates the development of African aviation such as ensuring full implementation of YD, negotiating ASAs as a block and not as individual countries, ensuring an even playing field and avoid favouring non-African carriers that are given more frequencies of services by some States that are denied their African counterparts, ensuring that costs of doing business in Africa are competitive and helping in ensuring the establishment of a major African hub in West and Central Africa.

Industry Costs

The Association will re-double efforts to sensitize and lobby Governments, airports and other service providers on the need to reduce taxes and charges and improve efficiency and services. AFRAA will also vigorously lobby for the removal of monopoly service providers to facilitate efficiency and provide choice to carriers. As this requires collaborative effort we will closely work with all relevant stakeholders.

Improved Infrastructure and Use of Technology

Currently, infrastructure in many African States is deficient, dilapidated and not coping with the growing airline industry. Although there are a significant number of exceptions, there is need to develop and expand airports, runways and air navigation services facilities. Airports should be open 24 hours a day and not just during daylight hours. There is need for the relevant authorities to be proactive and plan for the expected rapid expansion of African aviation.

The industry is behind the world in the adoption of cost effective technologies. It is important to take advantage of the latest information communication technologies including the use of mobile telephones, to minimise operating costs.

Promote the Implementation of AFCAP

Africa now has a common aviation policy endorsed in early 2013 by AU Heads of States. This is a major step forward, however, it needs to be implemented. This policy document should serves as the aviation development blueprint for Africa. The AU through the States should establish a monitoring mechanism for its implementation. There is need for an action plan with timelines for the implementation of specific goals. This can be done under the auspices of the AU and AFCAC. With this policy, Africa has an opportunity to adopt a common approach to many of the aviation challenges confronting the continent.

Human Resource Development

AFRAA will continue to strengthen the training unit to increase the number of training programmes that benefit members. We will continue to strengthen collaboration with IATA, our partners and others to jointly hold courses and seminars to keep African airlines abreast with the latest developments in the industry.

AFRAA will also continue to market the world class training facilities at member airlines including in Algeria, Egypt, Ethiopia, Kenya, Libya, Kingdom of Morocco, South Africa and Tunisia.

CONCLUSIONS

Ladies and Gentlemen: Thank you for your commitment and dedication. We have recorded many successful achievements but also face several challenges.

Africans are running a high risk of losing totally the African sky if appropriate measures are not immediately put in place to rectify the situation.

The biggest risk is seeing African carriers run out of business once by one with all the negative consequences such as job losses and lack of transportation facilities to promote the African tourism industry and to support the noble objectives of economic, social and political integration of the Continent.

AFRAA will continue to work with member airlines, its partners and other stakeholders so that collectively, we can overcome the challenges that confront us.

5 Responses

Reblogged this on gracemangenje and commented:

Despite all the challenges faced by the African Aviation Industry, full potential is yet to be achieved in this industry.

We are a bunch of volunteers and opening a new scheme in our

community. Your web site provided us with helpful info to work on. You have

done an impressive activity and our entire neighborhood

will probably be grateful to you.

Well thank you, for the compliments and for reading my blog.

W.